Introduction

In recent years, the pharmaceutical industry has been scrutinized for its staggering financial success and questionable contribution to tax revenues. Despite generating an astonishing $215 billion annually in the United States, many pharmaceutical companies seem to exploit legal loopholes and deductions, resulting in negligible tax payments. This article delves into the controversial issue of Big Pharma’s tax practices, shedding light on the reasons behind their massive profits and minimal tax contributions.

The Pharmaceutical Industry Landscape

The Enormous Revenue

Big Pharma, a term often used to describe the most prominent pharmaceutical corporations, operates within a highly lucrative market. With innovative drug development, cutting-edge research, and a constant stream of new medications, these companies have amassed astounding annual revenues. The industry’s collective revenue of $215 billion a year underscores its undeniable financial success.

Research and Development Costs

Behind the scenes, Big Pharma invests significant resources in research and development (R&D) to create new drugs that address various medical conditions. While these endeavors are commendable, they also contribute to the industry’s ability to offset taxable income. Substantial R&D expenses are tax-deductible, enabling pharmaceutical giants to lower their taxable profits substantially.

Tax Avoidance Strategies

Offshore Tax Havens

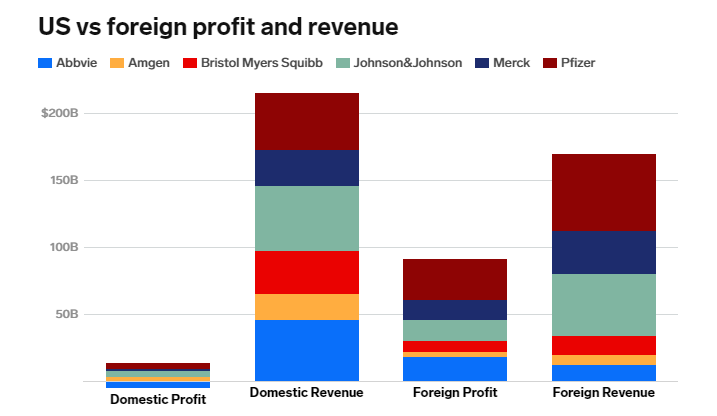

One of the most contentious issues surrounding Big Pharma’s tax practices is the utilization of offshore tax havens. By establishing subsidiaries in countries with lenient tax regulations, pharmaceutical companies can funnel profits to these locations, significantly reducing their tax liabilities in the United States. This practice, though legal, raises ethical concerns about contributing a fair share to the nation’s finances.

Intellectual Property and Patents

Pharmaceutical corporations often hold valuable patents for their drugs, granting them exclusive rights to produce and distribute these medications. By leveraging intellectual property laws and transferring patent rights to low-tax jurisdictions, these companies can further minimize their tax burdens. Such strategies showcase the intricate ways in which Big Pharma maneuvers its financial operations to maximize profits.

Government Policies and Lobbying Influence

Tax Code Complexity

The complexity of the U.S. tax code also plays a role in enabling Big Pharma’s tax avoidance strategies. The intricate web of deductions, credits, and exemptions creates opportunities for companies to exploit loopholes legally. Lobbying efforts by the pharmaceutical industry have, at times, influenced tax code revisions that favor their financial interests.

Political Influence and Lobbying

The immense financial power of pharmaceutical corporations extends to political contributions and lobbying efforts. These companies wield significant influence in shaping policies that affect their tax obligations. By supporting political candidates and advocating for favorable tax laws, Big Pharma can continue to thrive financially while minimizing its tax responsibilities.

Public Outcry and Potential Reforms

Heightened Public Awareness

In recent years, public awareness of Big Pharma’s tax practices has grown significantly. Social media campaigns, investigative journalism, and public protests have shed light on the industry’s financial maneuvers, leading to increased scrutiny from both the government and the public.

Calls for Reform

The mounting public pressure has prompted discussions about potential reforms to ensure that pharmaceutical companies contribute more equitably to tax revenues. Proposed measures include closing tax loopholes, increasing transparency, and implementing stricter regulations on offshore tax havens.

Conclusion

The pharmaceutical industry’s ability to rake in $215 billion annually while paying minimal taxes is a testament to its adeptness at navigating the complex landscape of tax regulations. Through strategies such as offshore tax havens, intellectual property maneuvers, and political lobbying, Big Pharma manages to optimize its profits while minimizing its financial obligations to the government. As public awareness grows and calls for reform amplify, the industry’s tax practices may face increased scrutiny, potentially leading to a more equitable contribution to the nation’s finances.

FAQs

Why does Big Pharma pay such minimal taxes?

Big Pharma utilizes various legal strategies, such as offshore tax havens and deductions, to minimize their taxable income, resulting in reduced tax payments.

Are pharmaceutical companies breaking the law with these practices?

No, these practices are generally legal, but they raise ethical concerns and prompt discussions about potential tax reforms.

What impact do these tax practices have on the economy?

The reduced tax payments by pharmaceutical companies can affect government revenue and public services, potentially leading to budget constraints.

How can the government address this issue?

The government can consider closing tax loopholes, increasing transparency, and implementing stricter regulations to ensure fairer tax contributions from Big Pharma.

What can consumers do to address this problem?

Consumers can support initiatives that advocate for tax reform, choose to engage with pharmaceutical companies that prioritize ethical financial practices and stay informed about industry developments.